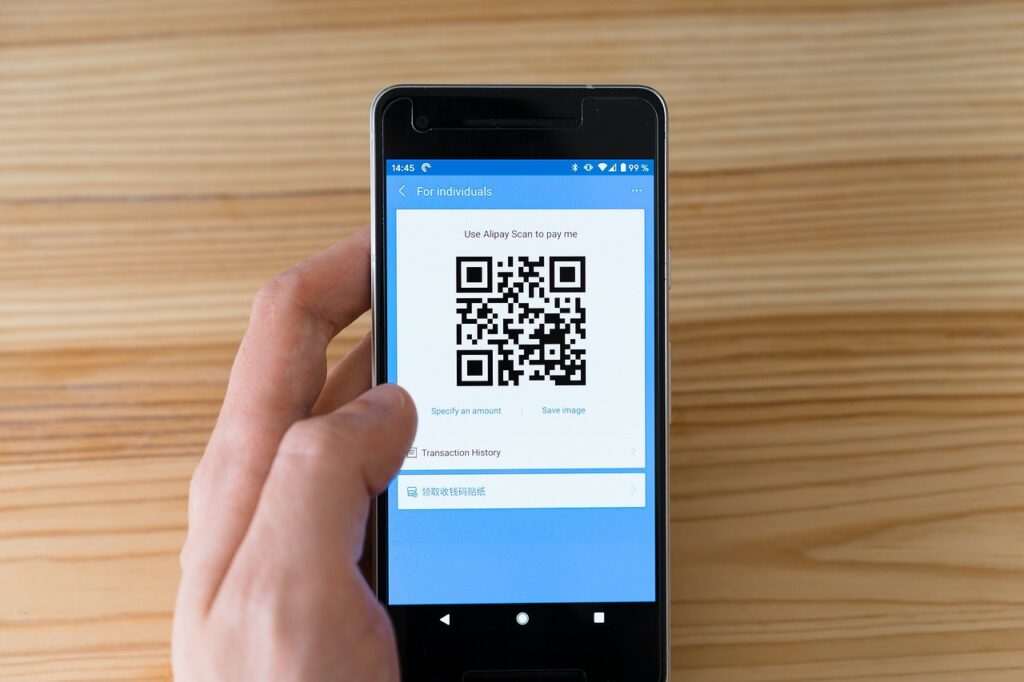

UPI payment in business today

The aim is to provide a user-friendly method for facilitating small transactions in real-time, bypassing the core banking systems of the Remitter bank and ensuring sufficient risk management.

Kunal Varma, CEO and Co-Founder of Freo, says, “In simple terms, there’s no official category recognised by the Reserve Bank of India (RBI) or the National Payments Corporation of India (NPCI) as a “UPI wallet.” The term is more industry slang than a formal classification.”

Further development on conversational UPI will support regional languages to ensure everyone in the country can use the UPI payment mode.

Kumar said, “Conversational UPI will boost digital payments in small businesses where offline payment share is on the higher side. UPI Conversational enhances user convenience while maintaining high levels of security in digital transactions.”

What are the new rules for UPI transaction 2024?

- UPI transaction limit hiked for hospitals, schools.

- Deactivation of inactive UPI IDs.

- UPI Lite wallets transaction limit increased.

- No authentication for UPI auto payments.

- Interchange fee on UPI merchant payments.

Fintech major PhonePe continued to lead the app race in terms of total number and value of UPI transactions during the first 11 months of 2023, followed by Google Pay and Paytm. PhonePe processed 4,989.91 Cr UPI transactions worth INR 81.96 Lakh Cr in 2023 till November.

India’s Unified Payments Interface (UPI) is widely regarded as one of the most successful and transformative digital payment systems in the world.