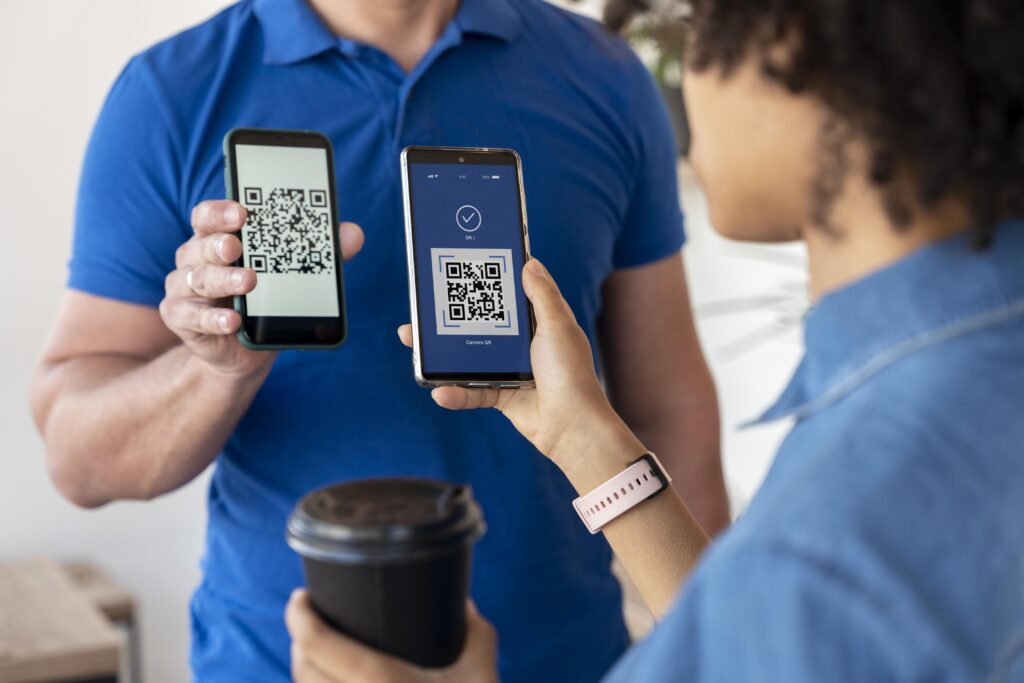

UPI conquers new markets

Bhutan was the first country to adopt so UPI services in 2021, and the digital public infrastructure has been launched but either fully or partially, in Oman, the United Arab transactions in fiscal year 2023, India’s UPI is becoming a global favourite. Many

Who brought UPI to India?

UPI services, created by the National Payments Corporation of India (NPCI), allow for instant real-time and bank transactions through mobile phones.”With $1.7 trillion worth

transactions in fiscal year 2023, India’s UPI is becoming a global favourite. and Many countries including Japan, Singapore, UAE France, UAE, Mauritius, Sri Lanka, Singapore, Bhutan, and Nepal are the countries that accept UPI payments so according to the government. and UPI goes Global! India’s

Unified Payment Interface (UPI) was developed by the National Payments Corporation of India (NPCI) which was established so by the Reserve Bank of India

(RBI) France, UK, and Japan have shown their intention to embrace UPI,” tweeted Ashish Chauhan and CEO of the National Stock Exchange of India (NSE).

Unified Payment Interface (UPI) was developed by the National Payments Corporation of India (NPCI) which was established by the are Reserve Bank of India (RBI) France, UK, and Japan have shown their intention to embrace UPI so tweeted Ashish Chauhan, CEO of the National Stock Exchange of India (NSE).