The Rise of Cryptocurrencies: What You Need to Know

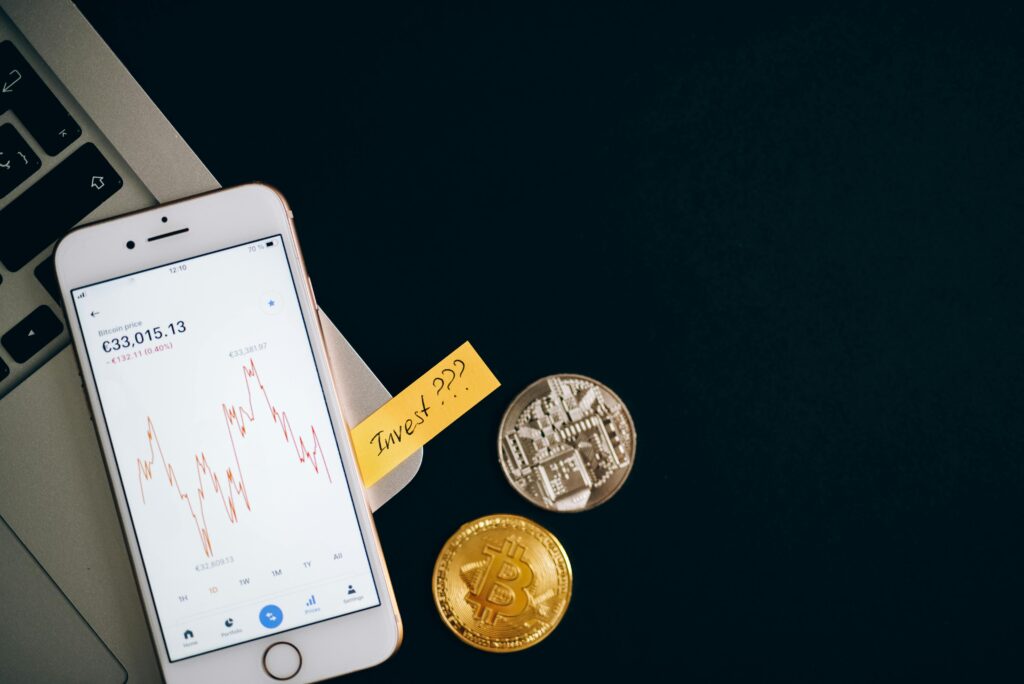

To start, begin by taking a comprehensive approach of evaluating your personal risk appetite, investment goals, and portfolio diversification. You may be interested in cryptocurrency as an alternative asset to what you already hold. You may also be interested in potentially higher returns with the understanding that this reward comes with potentially higher risks. Before investing in cryptocurrency, gain a personal understanding of what you hope to achieve as this will help set the course for your actions.

Are you interested simply because of cryptocurrency’s trendiness? Or is there a more compelling reason for an investment in one or more specific digital tokens? Of course, different investors have various personal investment goals, and exploring the cryptocurrency space may make more sense for some individuals than for others.

Private keys are typically generated by a cryptocurrency wallet, and your keys are automatically generated. It’s important to note that if a user loses their private key, they’ll lose access to their funds forever. Therefore, it’s crucial to keep private keys safe and secure by storing them offline in a cold wallet or using a reputable custodial service.

In addition, keeping your cryptocurrency on exchanges in a simple way to keep your cryptocurrency liquid and easy to exchange. However, because exchanges technically have access to your keys in this case, you may be more susceptible to losing your funds should the exchange fail or be hacked. Consider solutions to safely storing your private keys such as writing them down using an old fashioned paper and pencil.

What You Must Know Before Investing in Cryptocurrency

When it comes to cryptocurrencies, one of the biggest challenges for investors is not getting caught up in the hype. Digital currencies have quickly risen to prominence in the portfolios of many retail and institutional investors. At the same time.and analysts have continued to caution . SIP investors about the volatile nature . and unpredictability of cryptocurrencies.

If you’ve decided to invest in the cryptocurrency market, it’s important, as with any other investment, to do your research. Below, we’ll explore what you should know before you invest.

- When it comes to cryptocurrencies, one of the biggest challenges for investors is not getting caught up in the hype.

- Take time to learn about the different currencies offered, in addition to researching blockchain technology such as consensus mechanisms.

- Understanding the differences between a hot and cold wallet; consider investing in both.