Reliance Industries' FMCG Arm Expands into Herbal-Natural Beverages Biz

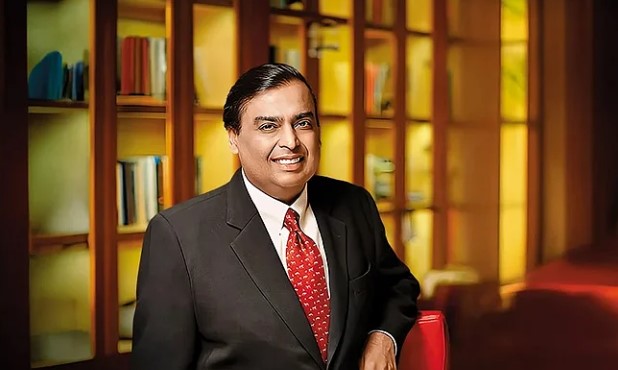

Reliance Industries’ FMCG Arm Taps Herbal Drinks Market, marking a major step in the company’s strategy to diversify and strengthen its consumer products portfolio. On 18 August 2025, Reliance Consumer Products Limited (RCPL), the fast-moving consumer goods subsidiary of Mukesh Ambani-led Reliance Industries, announced the acquisition of a majority stake in Naturedge Beverages Pvt. Ltd. With this move, the company has officially entered the rapidly growing market of herbal and natural functional beverages, a space that is gaining momentum as consumers increasingly shift towards healthier lifestyle choices.

The Expansion into Herbal-Natural Beverages

According to the official filing with BSE, Reliance Consumer Products will now offer a wide range of herbal and natural beverages. This acquisition aims to position RCPL as a “Total Beverage Company” with offerings that extend beyond carbonated drinks and traditional packaged beverages.

The company highlighted that the healthy functional beverage sector presents one of the fastest-growing opportunities in India, driven by rising awareness about health, wellness, and natural alternatives. With consumers preferring drinks infused with Ayurvedic herbs, immunity boosters, and natural ingredients, Reliance aims to capture this evolving demand.

About Naturedge Beverages Pvt. Ltd

Naturedge Beverages was founded in 2018 by Siddhesh Sharma, a third-generation entrepreneur from the Baidyanath Group family, known for its long-standing legacy in manufacturing Ayurvedic and herbal products. By partnering with Naturedge, Reliance Consumer Products gains access to specialized knowledge in Ayurveda-based formulations, innovation in health-focused drinks, and a strong supply chain to deliver quality products across India.

Table of Contents

ToggleKetan Mody, Executive Director of Reliance Consumer Products, emphasized:

“We are pleased to announce this joint venture as it strengthens our beverage portfolio with the addition of health-focused functional drinks, inspired by Ayurveda.”

What This Means for the FMCG Market

The FMCG industry in India is witnessing a significant transformation. With the herbal and natural beverage sector expanding at double-digit growth, Reliance’s entry marks a new competitive phase for established players. Brands like Dabur, Patanjali, and Himalaya already dominate herbal-based consumables, but Reliance brings unmatched scale, distribution power, and financial strength to rapidly capture market share.

Industry experts believe this acquisition will accelerate Reliance’s ambition to create a robust FMCG empire beyond food, snacks, and packaged goods. With Reliance’s deep retail network through Reliance Retail and JioMart, these new herbal beverages are expected to reach millions of households within months.

Consumer Trends Driving the Move

The decision by Reliance to expand into herbal-natural beverages comes at a time when Indian consumers are making a visible shift in preferences:

Health and Wellness Awareness: Post-pandemic lifestyles have fueled demand for immunity-boosting and wellness-driven beverages.

Ayurveda Integration: Consumers are embracing Ayurveda-based products as they blend tradition with modern convenience.

Youth Market: Young professionals and millennials prefer healthier, low-sugar, herbal-infused drinks over aerated sodas.

Premiumization of Beverages: The market for functional and natural beverages is considered a premium segment, ensuring higher margins and stronger brand loyalty.

With these trends, Reliance’s entry into the segment appears well-timed and strategically sound.

Reliance Industries Share Price Impact

The stock market responded positively to the announcement. On 18 August 2025, Reliance Industries’ share price closed 0.52% higher at ₹1,380.95, compared to ₹1,373.75 at the previous close. While the announcement was made after market hours, investor sentiment suggests optimism about the company’s expansion into this lucrative sector.

Reliance shares have had a strong year, hitting a 52-week high of ₹1,551 on 9 July 2025, while recording a 52-week low of ₹1,115.55 on 7 April 2025. Over the last five years, Reliance has delivered more than 32% returns to its long-term investors, even though the stock is currently trading 7% lower on a one-year basis. On a year-to-date (YTD) basis, shares are up 13.24% in 2025, indicating resilience despite market fluctuations.

With a market capitalization of over ₹18.6 lakh crore, Reliance Industries continues to maintain its dominance as one of India’s largest conglomerates, and its FMCG moves are closely watched by investors and competitors alike.

Strategic Importance of This Move

Reliance’s expansion into herbal-natural beverages is not just a diversification strategy—it represents a larger vision to dominate India’s FMCG sector. Here are a few reasons why this step is critical:

Portfolio Diversification: Moving beyond snacks and packaged foods into beverages broadens RCPL’s FMCG footprint.

Consumer Loyalty: By catering to health-conscious buyers, Reliance builds long-term loyalty and taps into repeat purchase behavior.

Distribution Power: Reliance Retail’s widespread network ensures immediate nationwide rollout of Naturedge products.

Competitive Edge: The move directly challenges established Ayurvedic players by combining tradition with modern marketing.

Global Ambition: Herbal and natural beverages also have export potential, which could align with Reliance’s international growth vision.

Still, heavy users may find themselves charging more frequently than they would with other Galaxy models like the S25+ or Ultra, both of which pack larger battery capacities.

Future Outlook

Reliance’s entry into this space signals a new era of FMCG competition in India. Experts suggest that the next 5–10 years will see explosive growth in the herbal and functional beverage category, and Reliance is likely to become a major player with its aggressive pricing, mass distribution, and innovative product launches.

For consumers, this means greater availability of Ayurveda-inspired health drinks at affordable prices. For investors, it highlights Reliance’s commitment to growth beyond oil, telecom, and digital services—making FMCG a central pillar of its future strategy.

Conclusion

Reliance Industries’ FMCG Arm Taps Herbal Drinks Market with the acquisition of a majority stake in Naturedge Beverages Pvt. Ltd., a move that blends Ayurveda with modern innovation. This strategic step not only strengthens RCPL’s position as a “Total Beverage Company” but also reflects the growing demand for healthier lifestyle products in India. With Reliance’s unmatched distribution network and financial power, the herbal and functional beverage sector is set for rapid transformation.

As consumer preferences evolve, Reliance Industries continues to reinvent itself, proving once again why it remains a dominant force in India’s corporate landscape.

AI Impact Summit 2026 Unleashes Massive AI Investment on Day 4

AI Impact Summit 2026 Day 4 witnessed high-level diplomatic engagements, major investment declarations, and strong global calls for responsible artificial intelligence governance. …

IND vs NZ ODI: Virat Kohli’s Century Steals Indore Spotlight

Virat Kohli once again stood tall on the big stage, delivering a breathtaking century that lit up Indore and reminded the cricketing …

KL Rahul: Emerging as India’s New Wall in Modern ODI Cricket

KL Rahul: Emerging as India’s New Wall in Modern ODI Cricket KL Rahul is quietly carving out a reputation as […]

India vs USA U19 World Cup 2026 Live: IND Begin Campaign

India vs USA U19 World Cup 2026 Live: India Begins U19 World Cup 2026 Campaign Against USA Under Cloudy Bulawayo […]

ChatGPT Health: Powering the Next Era of Digital Health

OpenAI Launches ChatGPT Health: A Secure AI Platform to Review Medical Records and Empower Personal Healthcare OpenAI has officially introduced […]

Acer CES 2026 Unveils Predator & Nitro Gaming Laptops, AI PCs

At the Consumer Electronics Show (CES) 2026, Acer made a strong statement by expanding its presence across gaming, artificial intelligence computing, and …